In our last post earlier this week, we wrote a bullish call on Fission 3.0 Corp. (FUU.V) (FISOF). With that stock having doubled since then, we think it's wise to take profits and focus back on Surge Battery Metals Inc. (NILI.V) (NILIF). At $0.165, NILI is up 65% from our call at $0.10, but we think it is on its way to at least $0.30 in the short term with much higher prices down the road upon successful drill results. $0.30 was the price it was last year before the recent high grade at-surface lithium samples at its Nevada North Lithium Project were announced. So even though it's up 65% in the month since we called it, there is still an opportunity to buy low before the hype really sets in. We are up to 1,004 followers on our ValueTrades blog despite not giving out a lot of alerts, a fact that we think is indicative of a successful, diligent and prudent stock picking history. If you like our picks you can also follow this blog by clicking the follow button on the top of the left hand panel. We have 91 followers so far on here. You can also follow us on Twitter @StockTradePicks which has over 5,000 followers.

As reminder, here is the press release on October 19 that started this run:

VANCOUVER, BC / ACCESSWIRE / October 19, 2022 / Surge Battery Metals Inc. (the "Company" or "Surge") (TSXV:NILI)(OTC PINK:NILIF)(FRA:DJ5C) is pleased to report that the first hole of an eight-hole reverse circulation drill program has confirmed the potential for a high-grade lithium deposit existing at the Nevada North Lithium Project located north of Wells, Nevada.

Six representative and randomly selected samples of silty clay, taken from varying depths (see table below) in drill hole NN22-01, range from a low of 1,790 ppm to high of 4,500 ppm lithium (average 3,093 ppm lithium). Full drill results will be announced once received from the lab, expected in two to three weeks.

Table 1. Lithium sample results vertical drill hole NN22-01, total depth 82.3m (270ft).

- 3170ppm from 3.0m to 4.6m, (10 to 15ft); tan clay with fine tuff sand

- 4500ppm from 9.1m to 10.7m, (30ft to 35ft); blue green silty clay

- 1790ppm from 16.8m to 18.3m, (55ft to 60ft); blue green silty clay

- 1990ppm from 59.5m to 61m, (195ft to 200ft); dark blue-grey silty clay

- 2980ppm from 61.0m to 62.5m. (200 ft to 205ft); dark blue-grey silty clay

- 4130ppm from 62.5m to 64m, (205ft to 210ft); dark blue-grey silty clay

Initial results from drill hole NN22-01 confirm that significant surface lithium soil values of up to 5,120 ppm lithium also continue to a depth of over 64m (200 ft). Drilling in all holes encountered similar silty clay units ranging in drilled depths of up to 91.5m (300ft) in most holes and up to a depth of 160m (525 ft) in drill hole NN22-07.

The maiden drilling program was implemented to test an area of about 1,700 meters east-west occurring in two bands, each about 300 to 400 meters wide that outlined a highly anomalous zone containing abundant sample points greater than 1,000 ppm lithium.

Mr. Greg Reimer, Company President & CEO states: "The initial drill sample results have confirmed that highly anomalous lithium values persist to depth in the silty clay unit that that appears to underlie the better soil values observed in samples collected last year and earlier this summer.

Our maiden drilling program has identified significant potential for a lithium deposit in an area of northern Nevada not previously recognized for its lithium potential. We look forward to seeing the completed assay results from the eight-hole program as they are received over the next few weeks. The Company plans to continue work at this exciting new discovery in the months ahead and we are well financed to do so."

Drilling utilized a buggy mounted system provided by O'Keefe Drilling Company of Butte, Montana. Site preparation and water handling were provided by Legarza Exploration of Elko, Nevada. Drill cuttings were collected on 5-foot intervals and bagged at the drill site by O'Keefe staff. Samples were collected from the site by the Surge Project geologist and delivered to the ALS Global sample preparation facility in Twin Falls, Idaho. Samples were dried, crushed, and pulverized at the Twin falls facility and sent to other ALS laboratories for analysis. Samples were assayed using the ALS ICP-41 method using an aqua regia leach followed by ICP optical emission spectrography. The detection level of lithium by this method is 10 - 10,000 ppm. Complete results are pending.

The full results are highly anticipated because investors want to know if the grades sampled at various depths in Hole 1 are consistent throughout the entire hole and within the other drill holes. As a point of reference, Thacker Pass, the lithium mine owned by Lithium Americas Corp. (LAC), has an average grade of 2,231 ppm lithium. The six five-foot samples announced so far average out to 3,093 ppm lithium. If these grades in the samples can be proven out across the entire length of the holes, NILI has an economically viable resource and a stock that should be worth much more than where it is today.

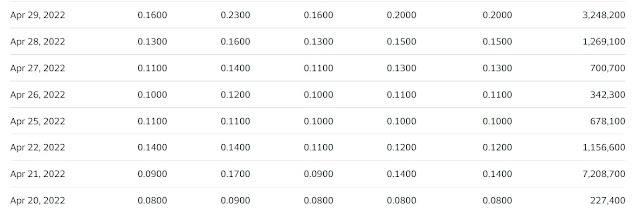

NILI has 96 million shares outstanding, which puts it around a $16 million market cap. A good comparable for NILI would be Nevada Sunrise Metals Corporation (NEV.V), which has a similar float of 91 million shares and a stock price of $0.235. Here is a screen shot of NEV's price history on April 21 when it first announced its discovery:

On April 21 NEV rose from $0.09 to $0.14. It pulled back to the $0.10 on the third trading day after initial results. Then it took off to over $0.20 on follow up results, surpassing $0.30 in June and hitting a high of $0.40 in August before pulling back to where it is today. We initially expected NILI to do this type of run in late October after its spike then pullback under $0.10, but the news that drill results were delayed by 2-3 weeks extended the timing for NILI. With the stock having increasing 1-2 pennies most days over the past two weeks, now it resembles the price history of NEV in late April. NEV's press releases on April 21 and 29 featured 950 ppm Lithium over 200 Feet and 1,203 ppm Lithium over 580 Feet. After that second press release, NEV hit a high of $0.23. Expectations are that NILI will report a significantly higher grade that that. Expect further buying in anticipation of the drill results with multi-bagger potential if the grades are consistent across the entire length of the holes.

Disclosure: We are long NILI.V