The small cap market in Canada has been absolutely brutal over the last several months. The only saving graces have been battery metals, particularly lithium plays. One such play with a recent significant discovery is Surge Battery Metals Inc. (NILI.V) (NILIF). It ran from $0.09 to $0.13 on October 19 after announcing that discovery and as of Friday afternoon it has pulled back to $0.10. We think this is an ideal time to get in as it will almost certainly continue its run on general sector hype as well as expectations of further results in the coming weeks. We are up to 1,005 followers on our ValueTrades blog despite not giving out a lot of alerts, a fact that we think is indicative of a successful, diligent and prudent stock picking history. If you like our picks you can also follow this blog by clicking the follow button on the top of the left hand panel. We have 89 followers so far on here. You can also follow us on Twitter @StockTradePicks which has over 5,000 followers.

The press release on October 19:

VANCOUVER, BC / ACCESSWIRE / October 19, 2022 / Surge Battery Metals Inc. (the "Company" or "Surge") (TSXV:NILI)(OTC PINK:NILIF)(FRA:DJ5C) is pleased to report that the first hole of an eight-hole reverse circulation drill program has confirmed the potential for a high-grade lithium deposit existing at the Nevada North Lithium Project located north of Wells, Nevada.

Six representative and randomly selected samples of silty clay, taken from varying depths (see table below) in drill hole NN22-01, range from a low of 1,790 ppm to high of 4,500 ppm lithium (average 3,093 ppm lithium). Full drill results will be announced once received from the lab, expected in two to three weeks.

Table 1. Lithium sample results vertical drill hole NN22-01, total depth 82.3m (270ft).

- 3170ppm from 3.0m to 4.6m, (10 to 15ft); tan clay with fine tuff sand

- 4500ppm from 9.1m to 10.7m, (30ft to 35ft); blue green silty clay

- 1790ppm from 16.8m to 18.3m, (55ft to 60ft); blue green silty clay

- 1990ppm from 59.5m to 61m, (195ft to 200ft); dark blue-grey silty clay

- 2980ppm from 61.0m to 62.5m. (200 ft to 205ft); dark blue-grey silty clay

- 4130ppm from 62.5m to 64m, (205ft to 210ft); dark blue-grey silty clay

Initial results from drill hole NN22-01 confirm that significant surface lithium soil values of up to 5,120 ppm lithium also continue to a depth of over 64m (200 ft). Drilling in all holes encountered similar silty clay units ranging in drilled depths of up to 91.5m (300ft) in most holes and up to a depth of 160m (525 ft) in drill hole NN22-07.

The maiden drilling program was implemented to test an area of about 1,700 meters east-west occurring in two bands, each about 300 to 400 meters wide that outlined a highly anomalous zone containing abundant sample points greater than 1,000 ppm lithium.

Mr. Greg Reimer, Company President & CEO states: "The initial drill sample results have confirmed that highly anomalous lithium values persist to depth in the silty clay unit that that appears to underlie the better soil values observed in samples collected last year and earlier this summer.

Our maiden drilling program has identified significant potential for a lithium deposit in an area of northern Nevada not previously recognized for its lithium potential. We look forward to seeing the completed assay results from the eight-hole program as they are received over the next few weeks. The Company plans to continue work at this exciting new discovery in the months ahead and we are well financed to do so."

Drilling utilized a buggy mounted system provided by O'Keefe Drilling Company of Butte, Montana. Site preparation and water handling were provided by Legarza Exploration of Elko, Nevada. Drill cuttings were collected on 5-foot intervals and bagged at the drill site by O'Keefe staff. Samples were collected from the site by the Surge Project geologist and delivered to the ALS Global sample preparation facility in Twin Falls, Idaho. Samples were dried, crushed, and pulverized at the Twin falls facility and sent to other ALS laboratories for analysis. Samples were assayed using the ALS ICP-41 method using an aqua regia leach followed by ICP optical emission spectrography. The detection level of lithium by this method is 10 - 10,000 ppm. Complete results are pending.

The company followed this up with an announcement that it expanded its land holdings. Dissecting this news release, we see that NILI is in a very favorable position. These are significant sample drill results starting basically at surface. This is within Nevada, where mining and exploration will be hot and heavy, but it's in a region not previously known for lithium. It's a complete wild card for how in demand this region will get, which will allow for high levels of speculation. Particularly in the near term as investors and traders wait for the full drill results in the next two to three weeks. On top of the potential for speculation, the company had $2.7 million in cash at the end of Q2, so the chances of dilution that would stifle a major run is low.

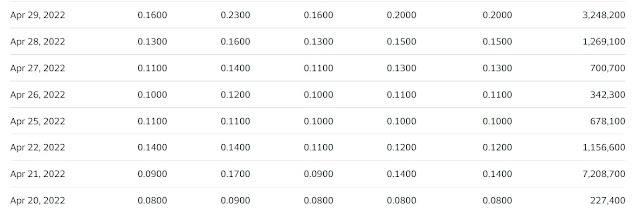

NILI has 96 million shares outstanding, which puts it around a $10 million market cap. A good comparable for NILI would be Nevada Sunrise Metals Corporation (NEV.V), which has a similar float of 91 million shares. Here is a screen shot of NEV's price history on April 21 when it first announced its discovery:

Look familiar huh? On April 21 it rose from $0.09 to $0.14. It pulled back to the $0.10 on the third trading day after initial results. Then it took off to over $0.20 on follow up results - a lot like what NILI is planning to give us over the next couple of weeks. NEV's press releases on April 21 and 29 featured 950 ppm Lithium over 200 Feet and 1,203 ppm Lithium over 580 Feet. More results are to come. Even if the first hole is complete, it shows NILI's much higher grades at smaller intervals starting at the surface that average out to 464 ppm over 200 feet as its lower boundary. If the hole is shown to have consistent grades throughout, it could be far superior to NEV's findings, with that discovery being 300 feet deep before it starts. All things considered, these are comparable discoveries right now with NILI having potential to be much more.

NEV has a market cap of $26 million. That is where NILI is headed, a stock price of over $0.25. This doesn't take into account that NEV and other smaller lithium players could go on a run, as Lithium Americas Corp. (LAC) is up huge today and we expect some run off to the smaller lithium players next week.

Disclosure: We are long NILI.