In our last post on March 18, we said that High Grade Gold Intercepts Should Send Awalé Resources Limited (ARIC.V) Flying. About a week later the stock rose from $0.25 to over $1.00. We think that we have identified a gold stock with similar unique potential. Ramp Metals Inc. (RAMP.V) has shot up from $0.15 to $0.74 on its high grade gold results, assisted by the fact that it has only 33 million shares outstanding. Leviathan Gold Ltd. (LVX.V) has the same potential as ARIC or RAMP. With only 20 million shares outstanding and $3 million in the bank, it incredibly trades below its net cash at a stock price of $0.125 despite recent gold results comparable to RAMP. We are up to 1,015 followers on our ValueTrades blog despite not giving out a lot of alerts, a fact that we think is indicative of a successful, diligent and prudent stock picking history. If you like our picks you can also follow this blog by clicking the follow button on the top of the left hand panel. We have 120 followers so far on here. You can also follow us on Twitter @StockTradePicks which has over 5,000 followers.

From the news release:

Leviathan Gold, via Core Prospecting Pty Ltd. Receives High Grade Assay Results, from Initial Phase of Diamond Drilling at the Excelsior Prospect

- Highlights include 4.85 meters at 9.0 g/t Au (43.66 gram meters) in hole EH014, 3.13 meters at 56.9 g/t Au (178.23 gram meters), in hole EH017 and 12.68 meters at 9.2 g/t Au, (116.85 gram meters), in hole EH029.

- A total of 1964.65 meters of diamond drilling over 16 holes has been completed by Core Prospecting Pty Ltd.

- Drilling identifies mineralized dilational zone opening to the northeast, remaining open along strike and depth.

VANCOUVER, British Columbia, June 25, 2024 (GLOBE NEWSWIRE) -- Leviathan Gold Ltd. (“ Leviathan ”, the “ Company ”) (LVX – TSXV, 0GP – Germany) is pleased to announce receipt of full assay results from an initial phase of diamond drilling completed at its Excelsior Prospect (“Excelsior”) pursuant to a Heads of Agreement entered into between Leviathan and Core Prospecting Pty Ltd (“ Core ”) on July 17, 2023 as subsequently amended on January 16, 2023 (“ HOA ”). The most prominent intervals among these results are presented in Table 1, and include 4.85 meters at 9.0 g/t Au (43.66 gram meters) in hole EH014, 3.13 meters at 56.9 g/t Au (178.23 gram meters), in hole EH017 and 12.68 meters at 9.2 g/t Au, (116.85 gram meters), in hole EH029. Additional drilling will be required to determine the true thickness of mineralization. Further pursuant to the HOA, Leviathan has received notification from Core of its intention to commence a second phase of diamond drilling at Excelsior. Accordingly, as a result of Core completing the initial phase of diamond drilling it has earned a 40% interest in in a New Tenement to be applied for by Leviathan, subject to the fulfilment of certain further conditions by Core.

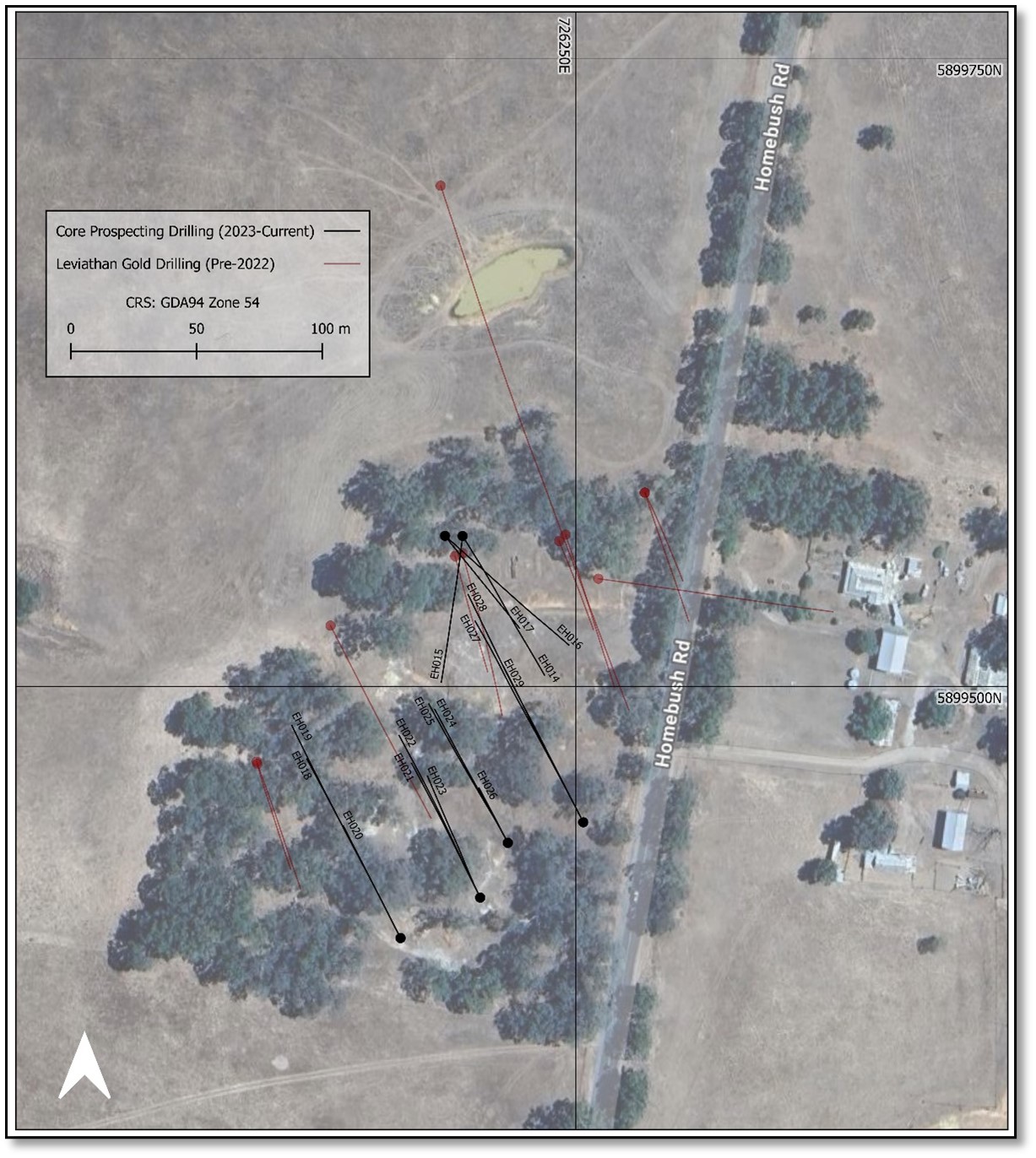

A total of 1964.85 meters of diamond drilling over 16 holes has now been completed by Core in a series of generally parallel south-eastward and north-westward oriented fans of drill holes designed to test for continuations of known mineralization (Figure 1).

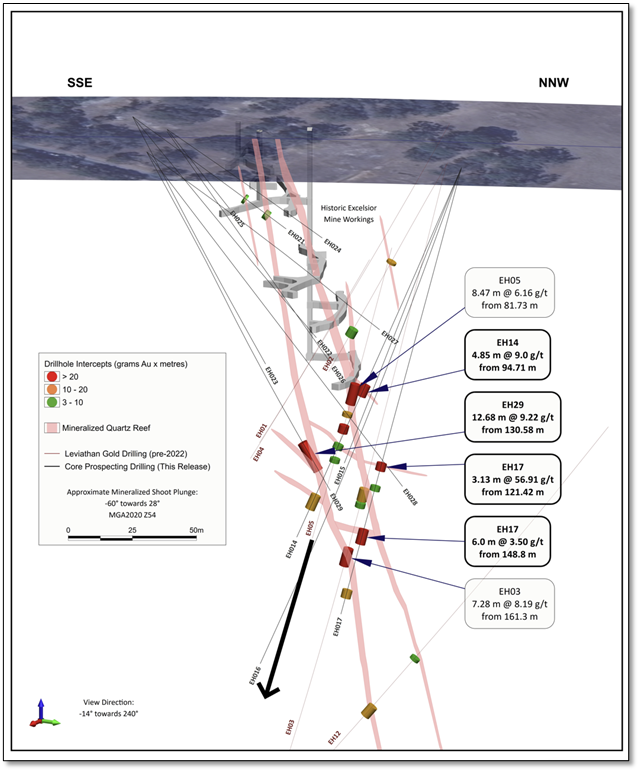

The purpose of the Core program was to drill beneath and along-structure from intervals previously reported by Leviathan from Excelsior, which include 8.24 g/t Au over 6.63 meters (54.63 gram meters), from 161.95 meters in hole EH003 (press release of April 21, 2021) and 5.40 g/t Au over 11.02 meters (59.51 gram meters), from 84.37 meters in hole EH005 (press release of April 26, 2021). These intervals are believed to represent the down-dip continuation of mineralization observed in historic mine workings, and are characterized by intense quartz veining, visible gold, and enveloping sericitic alteration and base metal sulphides.

Interpretative work on drilling completed to date suggests the presence of a north-eastward plunging mineralized dilational zone consisting of quartz reef and associated splays in which gold is hosted in quartz veins. It may be inferred from the results of drilling, most particularly from hole EH029 that this dilational zone opens to the northeast, in which regard it remains open along strike and depth. This feature will be the subject of further drill-testing.

Highlights of results to date are provided in Table 1, collar information in Table 2, and full results in Table 3.

Figure 1: Plan of drilling at the Excelsior Reef

Figure 2: Oblique section showing drilling and mineralized intervals at the Excelsior Reef

Table 1: Significant intervals from drilling at the Excelsior Reef, current release

| Drill Hole | From | To | Interval | Au | Au |

| (m) | (m) | (m) | (g/t) | (gram meters) | |

| EH014 | 94.71 | 99.56 | 4.85 | 9.00 | 43.66 |

| EH014 | 120.65 | 122.87 | 2.22 | 3.15 | 6.99 |

| EH014 | 143 | 149.22 | 6.22 | 3.00 | 18.65 |

| EH017 | 121.42 | 124.55 | 3.13 | 56.91 | 178.13 |

| EH017 | 130.8 | 132.85 | 2.05 | 4.62 | 9.45 |

| EH017 | 148.8 | 154.8 | 6 | 3.50 | 20.99 |

| EH017 | 173.65 | 177 | 3.35 | 3.18 | 10.64 |

| EH029 | 130.58 | 143.26 | 12.68 | 9.22 | 116.85 |

Table 2: Collar data for drilling at the Excelsior Reef

| Hole ID | Easting (MGA 2020 Z54) | Northing (MGA 2020 Z54) | Elevation (m) | Azimuth (°) | Inclination (°) | Depth (m) |

| EH014 | 726,205 | 5,899,560 | 235.8 | 150 | -70 | 161.9 |

| EH015 | 726,205 | 5,899,560 | 235.8 | 188 | -65 | 140.9 |

| EH016 | 726,205 | 5,899,560 | 235.8 | 133 | -69 | 210 |

| EH017 | 726,205 | 5,899,560 | 235.8 | 142 | -75 | 184 |

| EH018 | 726,180 | 5,899,400 | 239.8 | 334 | -35 | 98 |

| EH019 | 726,180 | 5,899,400 | 239.8 | 334 | -51 | 149.7 |

| EH020 | 726,180 | 5,899,400 | 239.8 | 334 | -61 | 101.2 |

| EH021 | 726,212 | 5,899,416 | 239.8 | 334 | -36 | 74.45 |

| EH022 | 726,212 | 5,899,416 | 239.8 | 336 | -51 | 113.1 |

| EH023 | 726,212 | 5,899,416 | 239.8 | 339 | -62 | 110.8 |

| EH024 | 726,223 | 5,899,438 | 239.8 | 331 | -35 | 74.4 |

| EH025 | 726,223 | 5,899,438 | 239.8 | 333 | -52 | 39.8 |

| EH026 | 726,223 | 5,899,438 | 239 | 332 | -55 | 145 |

| EH027 | 726,253 | 5,899,446 | 238.2 | 333 | -36 | 110 |

| EH028 | 726,253 | 5,899,446 | 238.2 | 334 | -62 | 165 |

| EH029 | 726,253 | 5,899,446 | 238.2 | 332 | -64 | 155 |

*coordinates are in MGA2020 Z54, azimuths are referenced to grid north and inclinations are zero when horizontal and -90 when vertical true. .

Excelsior lies within the Company’s Avoca Project in the Victorian Goldfields, Australia. As a preliminary component of the HOA Core, a private small-scale mining contractor based in Bendigo, earned an initial 40% interest in a New Tenement covering a three-square kilometre area within EL5387 to be applied for by Leviathan by completing, at its sole cost, 2,000 meters of diamond drilling including assays by April 17, 2024, subject to the fulfilment of certain further conditions by Core.

Leviathan Gold Chief Executive Officer, Luke Norman, remarked: “We are delighted by the success of Core Prospecting’s Phase 1 program at Excelsior, and the potential for depth and strike extensions to known high-grade mineralization returned by our own drilling that this now reveals. This campaign provides Leviathan with the opportunity to define a high-grade gold deposit of significance, of particular interest and relevance given the recent success of others in Victorian gold exploration. We thank Core for their considerable efforts to date and look forward to working with their highly skilled team as this program continues to evolve."

About the HOA

Under the terms of the HOA, Core may earn an initial 40% interest in a three square kilometre area within EL5387 (the Excelsior Area of Interest, or “ AOI ”) by completing, at Core’s sole cost and expense, 2,000 meters of diamond drilling including assays by April 17, 2024 (“ Phase 1 ”), and a further 35% interest in the AOI for an additional 4,000 meters of diamond drilling including assays and preparing an independent JORC report (the “ JORC Report ”) identifying an Indicated and/or Measured Mineral Resource within 12 months from the end of Phase 1, each at Core’s sole cost and expense (“ Phase 2 ”). In lieu of completing such further drilling, Core may instead prepare, at its sole cost and expense, a JORC report containing Indicated and/or Measured Mineral Resources of not less than 50,000 ounces of gold at a cut-off grade of 2.5g/t Au within the AOI. Upon fulfilment of certain conditions by Core, Leviathan shall on behalf of Core apply for a standalone tenure over the AOI, (the “ New Tenement ”). If Core fails to complete Phase 2 they shall forfeit any interest under Phase 1 and shall have no interest in the AOI.

Upon Core having attained a 75% equity interest in the AOI, Leviathan may either contribute its share of costs and maintain its equity interest or be diluted pro-rata to a minimum carried interest of 5%, which Core shall purchase from Leviathan for the sum of AUD$150 per ounce of Indicated and/or Measured Mineral Resources as estimated in the JORC Report, payable upon commencement of gold production. Alternatively, Core may, within 12 months of the completion of Phase 2, purchase Leviathan’s holding in the AOI for the sum of AUD$75 per ounce of Indicated and/or Measured Mineral Resources in the JORC Report, or Core may within 12 months of the completion of Phase 2 purchase Leviathan’s holding in the Excelsior AOI by paying instalments of AUD$25,000 per quarter, increasing to AUD$75,000 per quarter, commencing from the date on which a New Tenement is granted and continuing for the life of any gold production mine located within the area of the AOI.

The HOA also provides that Leviathan may, subject to Core first completing Phase 1, claw back Core’s equity stake in the AOI for the sum of AUD$500 per meter drilled, or after receipt of the JORC Report for AUD$150 per ounce of gold mineralisation estimated and classified as an Indicated Mineral Resource and/or a Measured Mineral Resource in the JORC Report.

While LVX potentially owns only 25% of the Excelsior project, that comes with Core funding the project. LVX has the opportunity to claw back Core's equity stake in exchange for a payment that the company can do. So LVX either trades below its cash value and will retain much of the cash as the drilling partner continues to spend on drilling, or it can deploy the cash to earn back a larger stake in the project. Either way, LVX is undeniably undervalued.

Let's highlight this table from the release again:

The three best intercepts were 4.85m at 9 g/t, 3.13m at 56.91 g/t and 12.68m at 9.22 g/t. an intercept report card created at aaronmcm.com shows the following ratings for these three intercepts:

Compare that to the top intercept discovered by RAMP, which led to its major spike:

The grade of the LVX discoveries are all at least in the top 7% of all discoveries out there. The best one is in the top 1% and is comparable to the RAMP discovery. In terms of length, the thickest of the three sits in the top 6% and is of superior length to RAMP's. RAMP's project is in an area not known for gold and there is strong potential for more prospective finds. That's what is causing the robust stock price reaction. But it makes absolutely no sense for LVX to languish at under $3 million market cap (under its net cash) when RAMP has increased to a $25 million market cap on comparable results. With only 20 million shares outstanding, we expect a tremendous lift in LVX's stock price once word catches on about this undervalued gem.

Disclosure: We are long LVX.V